When Must Insurable Interest Exist for a Life Insurance Contract

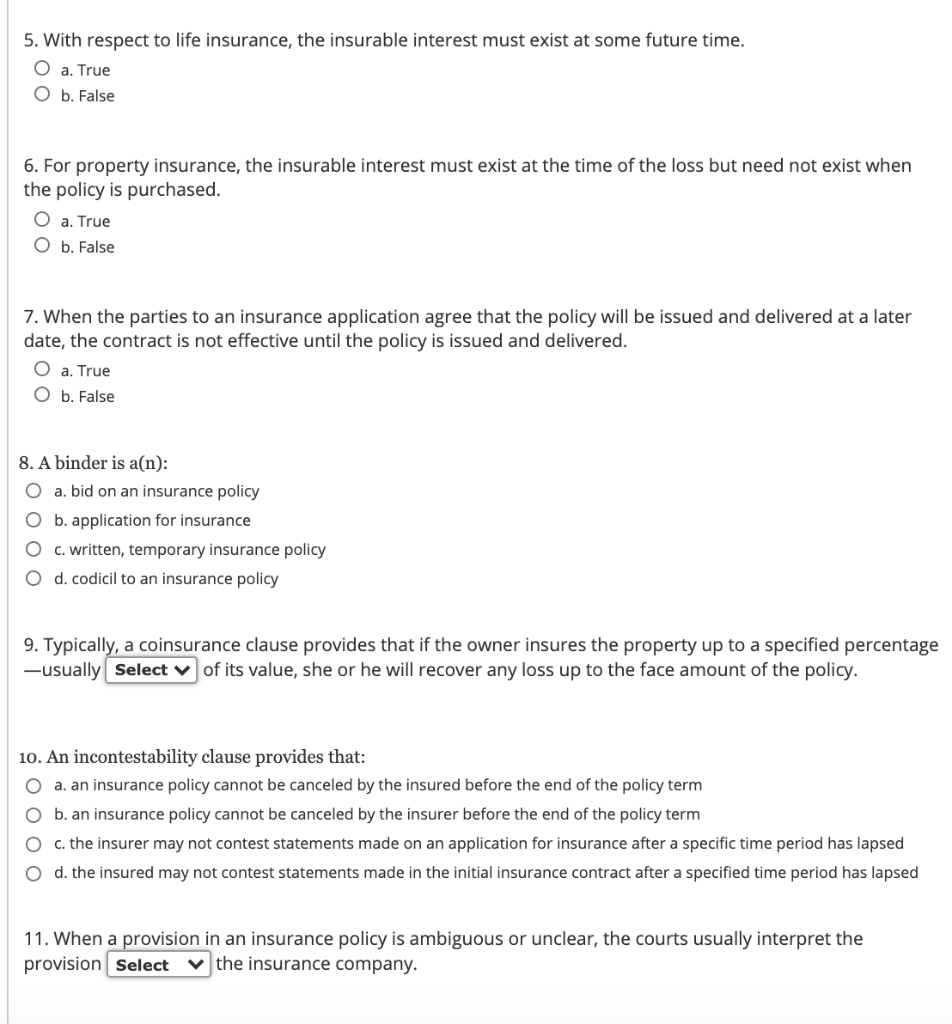

This is a basic requirement for a life insurance contract. It must continue for the life of the policy.

When Must Insurable Interest Exist For A Life Insurance Contract To Be Valid Lisbdnet Com

When must insurable interest exist for a life insurance contract to be valid.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

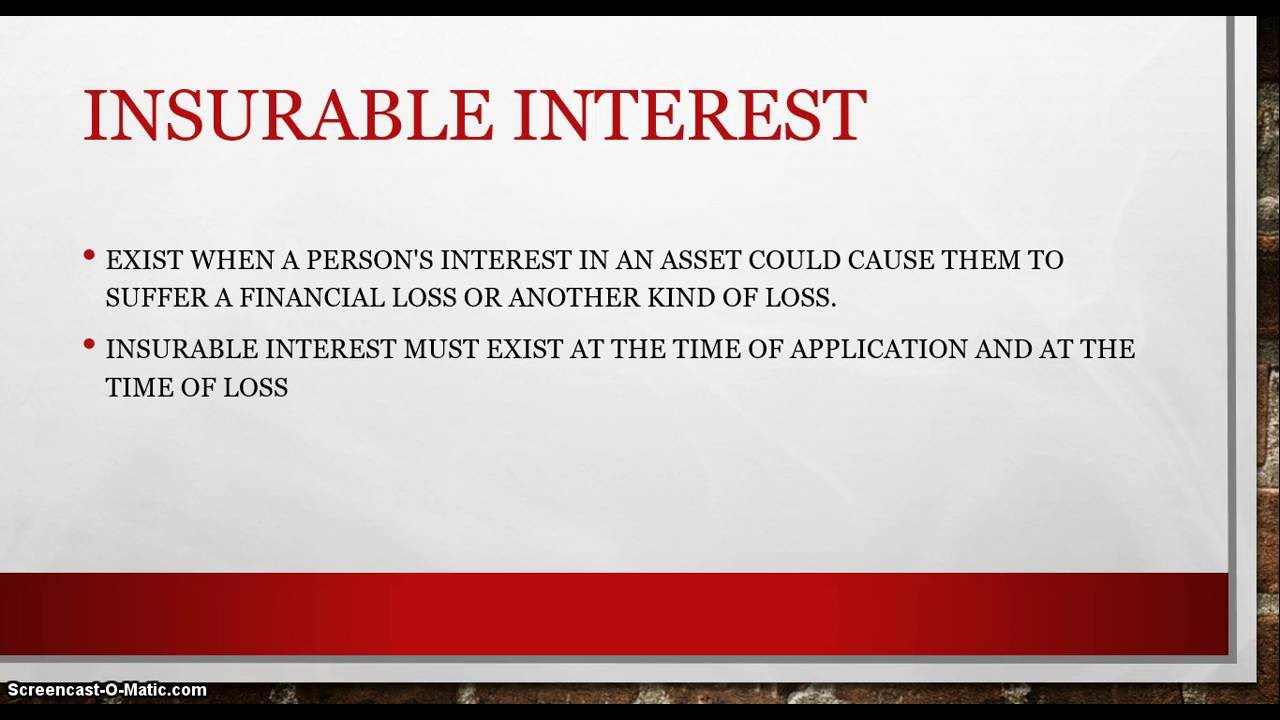

. Insurable interest must exist only at the time the applicant enters into a life insurance contract. If no insurable interest exists when a policyowner buys a life insurance policy the contract may still be enforced. What kind of contract is this.

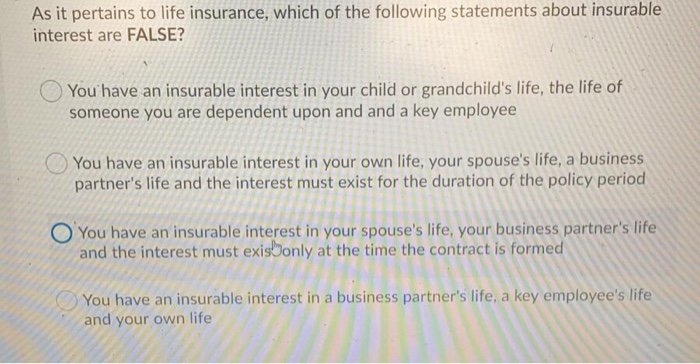

Insurable interest must exist only at the time the applicant enters into a life insurance contract. If there is an insufficient insurable interest between the policyholder and the insured the policy is voided. A only at the time of the insureds death B only at the inception of the policy C only at the time the beneficiary is paid D both at the time of the insureds death and at the inception of the policy.

It must continue for the life of the policy. In the life of another. If no insurable interest exists when a policyowner buys a life insurance policy the contract may still be enforced.

An insurable interest is a non-negotiable requirement for any form of any insurance including life insurance. In other insurance contracts insurable interest exist at the time of loss only. For example you cant buy a life insurance policy on a person and then not be in their lives or financially dependent on them when they pass away and expect a payout.

The legal precedent for insurable interest was solidified in Warnock v. It must continue for the life of the policy. If no insurable interest exists when a policyowner buys a life insurance policy the contract may still be enforced.

When must an insurable interest exist for a life insurance policy. Anyone can buy life insurance if they qualify but not everyone qualifies and not for reasons you may think. Inception of the contract Throughout the entire length of the contract When the insured dies During the contestable period.

Always but its a requirement that applies to the owner with the person being insured. In other words neither the policyholder nor any beneficiaries need to maintain an insurable interest to collect life insurance proceedstake for example a husband and wife who later divorce. In life insurance policies insurable interest must exist at the issue of the policy.

It must continue for the life of the policy. Insurable interest must exist only at the time the applicant enters into a life insurance contract. The person who is purchasing the policy needs to have an insurable interest in the insured person.

Insurable interest means in simple terms that someone would experience financial hardship upon your death. Insurable interest must exist only at the time the applicant enters into a life insurance contract. It must continue for the life of the policy.

Insurable interest must exist at the time of claim although it need not exist at the time of effecting the policy. While life insurance applications determine your likelihood of dying relatively soon to determine a life insurance companys risk you must also prove there is an insurable interest its the law. What is insurable interest in life insurance.

--inception of the contract Use of XYZ Insurance Company brochures business cards and rating guides is. When must insurable interest exist in a life insurance policy. Both at the time of death and at the inception of the policy.

Therefore if you would like to financially protect someone that does not have an insurable interest in your life you can purchase a life insurance policy on your life naming that person as the. When must insurable interest exist for a life insurance contract to be valid. In life insurance insurable interest must exist between the policyowner and the insured at the time of the application.

If no insurable interest exists when a policyowner buys a life insurance policy the contract may still be enforced. If insurance is taken out on the life of a 3 rd person other than a spouse the insured must prove that he has a specific pecuniary interest in the life insured and the amount of the insurance cannot be higher than the value of the interest at the time of the contract. Example of insurable interest beneficiary.

If no insurable interest exists when a policyowner buys a life insurance policy the contract may still be enforced. At the time the beneficiary is paid. When must an insurable interest legally exist in life insurance.

Insurable interest must only exist at the time of the insureds death One person benefits from another persons continued life Voluntarily terminating an insurance policy is also known as. It must exist when a claim is submitted. All other interest insurable under a contract of capital insurance in English law is to be of a financial nature.

It must exist when a claim is submitted. Insurable interest must exist only at the time the applicant enters into a life insurance contract. The law states that insurable interest must be present both when buying the life insurance policy and at the time of loss.

Solved 5 With Respect To Life Insurance The Insurable Chegg Com

Solved As It Pertains To Life Insurance Which Of The Chegg Com

Comments

Post a Comment